National Correspondent Operations and Program Updates

On this page you'll find the latest information from Plaza Home Mortgage® and our response to COVID-19 as it relates to our lending operations and programs. Check back regularly for updates, or contact your Plaza Account Executive with if you have questions regarding our current operations.

8.17.20 Update: Please refer to the Temporary Credit Policy document

Plaza Home Mortgage has issued a COVID-19 Temporary Credit Policy document that contains the most up-to-date guidance on COVID-19 related loan processing and underwriting policies. All further COVID-19 related updates will be contained in the Temporary Credit Policy document, available in the Plaza Resource Center in the "UW Guidelines" folder, and we will no longer be making updates to this page.

Please contact your Plaza Account Executive for more information.

7.20.20 Update: Verbal Verification of Employment

Verbal Verification of Employment (VVOE) can be performed within ten (10) days of closing. Please refer to the Temporary Credit Policy Document in the Plaza Resource Center for all the details or contact your Plaza Account Executive with questions.

5.20.20 Update: Eligibility of Borrowers in Forbearance and Additional Documentation Requirements

On May 19, 2020, FHFA announced that Fannie Mae® and Freddie Mac (the Enterprises) issued temporary guidance that provides a path to home financing for borrowers who are in forbearance, or have recently ended their forbearance. Plaza is aligning with the Fannie Mae and Freddie Mac requirements.

Borrower Eligibility in Forbearance

Per Fannie Mae and Freddie Mac, borrowers are eligible to refinance or buy a new home if they are current on their mortgage (i.e. in forbearance but continued to make their mortgage payments or reinstated their mortgage), or three months after their forbearance ends and they have made three consecutive payments under their repayment plan, or payment deferral option or loan modification.

Additional Documentation Requirements

In addition, the Enterprises have added documentation requirements applicable to all loans, regardless of forbearance status, to verify that all mortgages for which the borrower is obligated on are current. These guidelines are effective for all Fannie Mae and Freddie Mac eligible loans with application dates on or after June 2, 2020.

Regardless of forbearance status, additional documentation must be obtained for each mortgage loan on which the borrower is obligated, including co-signed mortgage loans and mortgage loans not related to the subject transaction, to determine whether the payments are current as of the note date of the new transaction. Acceptable methods to document the loan file include:

- a loan payment history from the servicer or third-party verification service, or

- a payoff statement (for mortgages being refinanced), or

- the latest mortgage account statement from the borrower, or

- a verification of mortgage

Refer to Fannie Mae Lender Letter 2020-03 updated May 19, 2020, and Freddie Mac Guide Bulletin 220-17 for the complete announcement.

5.13.20 Update: Temporary Forbearance Pricing Policy Rescinded

Effective immediately, Plaza is rescinding the Temporary Forbearance Pricing Policy announced on April 29, 2020, that applied the following additional LLPAs on all agency purchase or no cash-out refinance transactions that enter into forbearance within 15 days of purchase by Plaza:

- 500 basis points (5.000%) for first-time home buyers, and

- 700 basis points (7.000%) for all other transactions

Note: All other applicable LLPAs and forbearance guidelines still apply.

4.29.20 Update: Temporary Forbearance Policy Update

Effective for agency loans purchased on or after April 30, 2020, Plaza will align its COVID-19 Temporary Credit Policy with Fannie Mae LL-2020-06 and Freddie Mac Bulletin 2020-12.

All agency purchase or no cash-out refinance transactions that enter into forbearance within 15 days of purchase by Plaza will be subject to the following LLPAs:

- 500 basis points (5.000%) for first-time home buyers, or

- 700 basis points (7.000%) for all other transactions

Note: These LLPAs are in addition to all other applicable LLPAs, and will be billed after purchase of the loan.

Reminder: Cash out refinances that enter into forbearance within 15 days of purchase by Plaza are subject to repurchase. Loans that are currently in forbearance are not eligible for purchase by Plaza.

Loan to Borrower Currently in Forbearance

Transactions where the borrower currently has a mortgage in forbearance are not eligible. If the borrower owns multiple properties with mortgages where one or more are in forbearance even if the subject property is not, the loan is not eligible.

4.28.20 Update: New Temporary Credit Policy Document

Plaza continues to monitor the COVID-19 situation and adapt to industry changes. With the amount of information being emailed to you each day, it can be overwhelming to keep track of the latest updates. To assist you, Plaza has created a single document consolidating all of our COVID-19 related policies into one Temporary Credit Policy, located in our Resource Center.

Note that there are three recent updates to the temporary policy:

- Additional guidance was announced by Fannie Mae® regarding Condominium Project Review Flexibilities and Plaza will be aligning with this guidance

- Reminder that the IRS did not postpone the filing of Forms 1065, 1065-B, 1066 and 1120-S and these forms may be required during the underwriting process

- Plaza will be aligning with the most recent VA Circular 26-20-13 that contains additional appraisal flexibilities. However, Plaza will require a clear termite report when there is known or visible evidence of termite infestation

You can view or download the document by going to the Plaza Resource Center, under UW Guidelines, and selecting COVID-19 Temporary Credit Policy Correspondent.

4.13.20 Update: Proof of Government Insuring

Effective starting April 15, 2020, Plaza Home Mortgage will require all Government loans to be insured within 30 days of the note date prior to purchase versus the previous 45 day period.

-

- FHA = Mortgage Insurance Certificate (MIC)

- VA = Loan Guaranty Certificate (LGC)

- USDA = Loan Note Guaranty (LNG)

4.9.20 Updates: Loans in Forbearance; Aged Loans; Secondary Financing and Others

Loans in Forbearance

The COVID-19 pandemic has changed the lives and income of homeowners and future borrowers throughout the nation. Fannie Mae and Freddie Mac have provided guidance regarding the eligibility of loans in forbearance and effective immediately, Plaza will be aligning with the GSEs. Any loan, conventional or government, in forbearance, or for which a forbearance has been requested, is not eligible for purchase. For conventional loans that go into forbearance, or for which a borrower requests a forbearance up to 15 days post-purchase by Plaza, it may result in a repurchase.

Resources:

EPD Provision

Due to fluctuating market conditions that are changing day-by-day, hour-by-hour caused by the COVID-19 emergency, Plaza is making multiple operational and program changes. As such, EPD provisions including Correspondent Seller Guide Section 7.2 are considered tolled during a borrower’s first forbearance due to COVID-19 (not to exceed 90 days). For purposes of this announcement, tolling means the pausing or delaying of the running of the period of time set forth in the EPD provisions.

Loan Delivery – Aged Loan Policy

Effective as of April 10, 2020, on new commitments for mandatory delivery and new locks on best efforts, all closed loans must be delivered to Plaza for purchase review on or before 20 days from the Note date. Further, all loans must be purchased by Plaza on or before 45 days from the Note date.

Secondary Financing

Effective as of April 10, 2020, on new commitments for mandatory delivery and new locks on best efforts:

-

-

Subordinate financing is allowed up to the maximum LTV limit per program guidelines. CLTV limits in excess of LTV limits are not allowed. This applies to all loan programs and all subordinate financing including down payment assistance programs and community/affordable seconds.

-

Document Age (Fannie Mae and Freddie Mac)

For conventional loan programs, Plaza is aligning with Fannie Mae and Freddie Mac to ensure that the most up to date information is being considered to support a borrower’s ability to repay. Sellers are encouraged to apply these updates to existing loans in process, however they must be applied to loans with applications dated on or after April 14, 2020 through May 17, 2020.

-

- Documents may be no more than two months (60 days) old for most income and asset documentation.

- If an asset account is reported on a quarterly basis, the most recent issued quarterly statement must be obtained.

- There are no changes to the age of documentation requirements for military income documented using a Leave and Earnings Statement, Social Security, retirement income, long-term disability, mortgage credit certificates, public assistance, foster care or royalty payments and the standard age of document requirements per the Plaza Credit Guides can be applied.

Fannie Mae Lender Letter 2020-03

Tax Returns

Due to the federal income tax filing extension granted through July 15, 2020, the following documentation requirements will be eliminated. These usually apply to income types that require copies of federal income tax returns when the mortgage has an application or disbursement date between April 15 and July 15.

-

- A copy of the IRS Form 4868 (Application for Automatic Extension of Time to File US Individual Tax Return) and

- IRS Form 4506-T (Request for Transcript of Tax Return) confirming “No transcript Available” for the 2019 tax year.

Market-Based Assets (Fannie Mae and Freddie Mac)

In light of current market volatility, for conventional loans Plaza is aligning with Fannie Mae and Freddie Mac related to the borrower using stocks, stock options, or mutual funds for assets:

-

- When used for down payment or closing costs, evidence of the borrower’s actual receipt of funds realized from the sale or liquidation must be documented in all cases.

- When used for reserves, only 70% of the value of the asset must be considered, and liquidation is not required.

Locks and Purchase Dates

-

- Current rules around lock extensions will apply for locked loans that do not meet the new overlay requirements, however no new locks and no re-locks will be allowed.

- Purchase-by date will be governed by lock expiration date.

Using Powers of Attorney to Close

At this time Plaza is not aligning with Fannie or Freddie Mac related to the Power of Attorney temporary guidance.

4.3.20 Update – Additional Updates to Temporary Appraisal Flexibility Policy

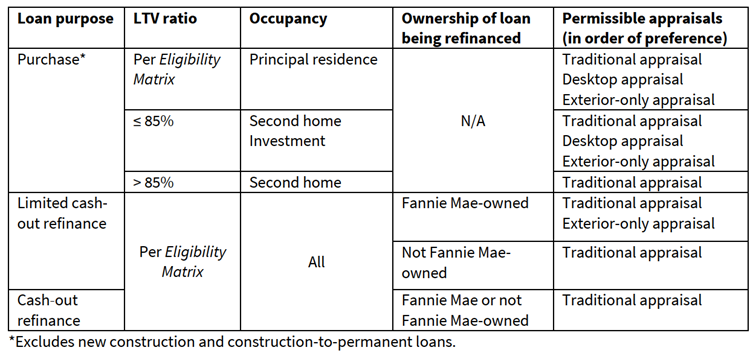

As we all adjust the ways in which we serve our clients as a result of COVID-19, Plaza is adopting the temporary Appraisal Flexibility Guidelines issued by the agencies. Below are details on our temporary policy as well as links to the detailed agency guidelines, along with a summary.

Fannie and Freddie

Plaza previously announced we will allow sellers to use Fannie Mae and Freddie Mac’s temporary appraisal policies. Below is an update to Plaza's existing announcement, issued on March 26, 2020, and can be reviewed further down this page.

Update Adding the Following

-

- Seller should attempt to obtain a full Interior/Exterior appraisal. If an Interior/Exterior appraisal is unable to be obtained, Plaza will allow for appraisal flexibility using a waterfall approach, attempting an Interior/Exterior appraisal first, then Desktop appraisal and then Exterior Only. Both Interior/Exterior appraisals and Desktop appraisals must still be submitted to the UCDP and have correlating SSR’s.

- Repair inspections - If a standard 1004D Evidence of Completion of Repairs cannot be obtained, the following flexible documentation is permissible:

- A letter signed and dated by the borrower confirming the work was completed accompanied by the following:

- Photos of the completed work, or

- Paid invoices, or

- Occupancy certificate/permit from the local authority

- A letter signed and dated by the borrower confirming the work was completed accompanied by the following:

Fannie Mae Lender Letter LL-2020-04

FHA Appraisal Documentation (Forward and Reverse)

Seller should attempt to obtain a full Interior/Exterior appraisal. If an Interior/Exterior appraisal is unable to be obtained, Plaza will allow for appraisal flexibility using a waterfall approach, attempting an Interior/Exterior appraisal first, then Desktop appraisal and then Exterior Only. Both Interior/Exterior appraisals and Desktop Appraisals must still be submitted to the EAD with correlating SSR’s.

FHA Summary of Flexible Appraisal Guidance

-

- A Desktop appraisal or Exterior Only appraisal is permissible

- Information may be obtained by the appraiser from an interested party to the transaction when additional verification is not feasible

- The Desktop or Exterior Only Report must be on current FHA approved forms with amended certifications and scope of work disclosures

- The Desktop Appraisal or Exterior Only Appraisal must include a signed certification indicating whether the property was or was not personally inspected and the extent of the inspection

- Full appraisals are required on the following program types:

- Cash-out Refinances

- New Construction

- Construction to Permanent

- 203(k) Standard and Limited

- Borrower building on their own land

- Repair inspections - If a standard 1004D Evidence of Completion of Repairs cannot be obtained, the following flexible documentation is permissible:

- A letter signed and dated by the borrower confirming the work was completed accompanied by the following:

- Photos of the completed work, or

- Paid invoices, or

- Occupancy certificate/permit from the local authority

- A letter signed and dated by the borrower confirming the work was completed accompanied by the following:

VA Appraisal Documentation

Sellers should attempt to obtain a full Interior/Exterior appraisal first and then, if unable to obtain, may apply the following flexibilities. The appraisal flexibility must be done in a waterfall approach, attempting an Interior/Exterior appraisal first, then Exterior Only and as a last choice a Desktop appraisal.

VA Summary of Flexible Appraisal Guidance

-

- If a full Interior/Exterior appraisal cannot be obtained, then an Exterior Only is permissible

- Unless there is a quarantine or shelter-in-place order has been issued, the appraiser must inspect the inside of the property. The appraiser is not required to inspect the inside of the property if any of the residences are sick with flu like symptoms or have been tested positive or quarantined for COVID-19

- A Desktop appraisal is only allowed if the appraiser indicates that an Interior/Exterior appraisal or Exterior Only is not able to be done

- Base loan amounts over the county loan limits will require a full interior/exterior appraisal

- Full Interior/Exterior appraisal is required on vacant properties

- Reconsiderations of Value if required must adhere to the following restrictions:

- Purchase transactions limited to 5% of appraiser’s opinion of value

- Not allowed on cash out refinances

- Not allowed on renovation loans

- Repair inspections – if a repair inspection cannot be completed by the Fee Appraiser, the lender can provide a certification that the repairs have been completed

- Termite inspections – if there is no known or evident infestation, the seller and realtor can provide a certification saying same. If there is evidence or knowledge of infestation, then a clear termite inspection must be provided within a year of close of escrow

- If a full Interior/Exterior appraisal cannot be obtained, then an Exterior Only is permissible

USDA Appraisal Documentation

Sellers should attempt to obtain a full Interior/Exterior appraisal first and then, if unable to obtain, may apply the following flexibilities. The appraisal flexibility must be done in a waterfall approach, attempting an Interior/Exterior appraisal first, then Exterior Only.

USDA Summary of Flexible Appraisal Guidance

-

- An Exterior Only appraisal is acceptable when the appraiser is unable to complete a full Interior/Exterior Report. This applies to both purchases and non-streamlined refinance transactions

- When an Exterior Only is obtained, the appraiser is not required to certify that the property meets HUD 4000.1 standards

- Full Interior/Exterior appraisal is required on new construction or construction-to-perm transactions

- If a standard 1004D Evidence of Completion of Repairs cannot be obtained, the following flexible documentation is permissible:

- A letter signed and dated by the borrower confirming the work was completed accompanied by the following:

- Photos of the completed work, or

- Paid invoices, or

- Occupancy certificate/permit from the local authority

- A letter signed and dated by the borrower confirming the work was completed accompanied by the following:

- An Exterior Only appraisal is acceptable when the appraiser is unable to complete a full Interior/Exterior Report. This applies to both purchases and non-streamlined refinance transactions

USDA Stakeholder Announcement, March 27, 2020

4.02.20 Update - Tax Transcripts and Updated Temporary VVOE Policy

Tax Transcripts

As a result of the IRS response to COVID-19, Plaza is temporarily suspending the need for tax transcripts.

Tax return transcripts may still be required per USDA program requirements. Sellers are advised to refer to USDA guidelines for more details.

Verbal Verification of Employment (VVOE) at Closing - Updated Temporary Policy

Note Regarding Reverification of Employment

-

- Correspondents remain responsible for ensuring that all borrowers are employed through closing.

- For loans already closed and delivered to Plaza, if verification is not performed within three (3) business days of the note date, reverification will be required prior to purchase.

Conventional (FNMA/FHLMC)

For delegated loans, Plaza will require that all reverifications of employment must be performed within three (3) business days of the note date. If the lender is unable to obtain a verbal verification of employment, Plaza will also accept as alternative documentation one of the following:

-

- The most recent pay stub dated within 14 calendar days of the note date, or

- A bank statement showing the most recent ACH payroll deposit within 14 calendar days of the note date, or

- An email from the employer to the lender directly, dated within three (3) business days of the note date. The email must identify the employer and the name and title of the person verifying employment, as well as the borrower’s name and current employment status. The person verifying the employment must be from the company’s Human Resources department or a Manager/Supervisor. The email must be from a business domain and not from a @gmail.com, @hotmail or @yahoo.com type account.

Third-Party Verifications: A third-party verification with companies like The Work Number will only be accepted if the vendor’s database has been updated within 14 calendar days of the note date showing the borrower is currently still employed.

Active Military Personnel: Plaza will follow the standard 10-day reverification requirements as detailed by Fannie Mae and Freddie Mac.

Self-Employed Borrowers: Effective immediately for all new loans with note dates 4.2.20, Plaza will require that the existence of the business be verified within 10 days of loan closing. Due to latency in systems updates or recertifications using licenses certification, or government system of records, sellers must take additional steps to confirm that the business is open and operating. The file must reflect that the borrower’s employment has continuity of income at the time it is being verified. Examples of confirming the business is currently operating include but not limited to the following:

-

-

- Evidence of current work (recent executed contracts or signed invoices that indicate the business is operating)

- Evidence of current business receipts within 10 days of closing

- The seller verbally verifying that the business is open and operating

- Business website demonstrating activity supporting current business operations (timely appointment for estimated or service can be scheduled)

-

FHA (Forward & Reverse)

For delegated loans, Plaza will require that all reverifications of employment must be performed within three (3) business days of the note date. If the lender is unable to obtain a verbal verification of employment, Plaza will also accept as alternative documentation one of the following:

-

- The most recent pay stub dated within 14 calendar days of loan closing (or funding in escrow states), along with evidence the borrower has a minimum of two (2) months of Principal, Interest, Taxes and Insurance (PITI) in reserves, (HECM’s do not require reserves), or

- A bank statement or printout showing the most recent ACH payroll deposit within 14 calendar days of loan closing (or funding in escrow states), along with evidence the borrower has a minimum of two (2) months of Principal, Interest, Taxes and Insurance (PITI) in reserves (HECM’s do not requires reserves).

- An email from the employer to the lender directly, dated within three (3) business days of the note date. The email must identify the employer and the name and title of the person verifying employment, as well as the borrower’s name and current employment status. The person verifying the employment must be from the company’s Human Resources department or a Manager/Supervisor. The email must be from a business domain and not from a @gmail.com, @hotmail or @yahoo.com type account.

Third-Party Verifications: A third-party verification with companies like The Work Number will only be accepted if the vendor’s database has been updated within 14 calendar days of the Note date showing the borrower is currently still employed.

Active Military Personnel: Plaza will follow the standard 10-day reverification requirements as detailed by FHA.

Self-Employed Borrowers: Effective immediately for all new loans with note dates 4.2.20, Plaza will require that the existence of the business be verified within 10 days of loan closing. Due to latency in systems updates or recertifications using licenses certification, or government system of records, sellers must take additional steps to confirm that the business is open and operating.The file must reflect that the borrower’s employment has continuity of income at the time it is being verified. Examples of confirming the business is currently operating include but not limited to the following:

-

-

- Evidence of current work (recent executed contracts or signed invoices that indicate the business is operating)

- Evidence of current business receipts within 10 days of closing

- The seller verbally verifying that the business is open and operating

- Business website demonstrating activity supporting current business operations (timely appointment for estimated or service can be scheduled)

-

FHA Streamlines: No change to current VVOE policy.

VA Loans

For delegated loans, Plaza will require that all reverifications of employment must be performed within three (3) business days of the note date. If the lender is unable to obtain a verbal verification of employment, Plaza will also accept as alternative documentation one of the following:

-

- The most recent pay stub dated within 14 calendar days of the note date and must contain at least a full months of employment, or

- A bank statement showing the most recent ACH payroll deposit within 14 calendar days of the note date and must contain at least a full month of employment, or

- An email from the employer to the lender directly, dated within three (3) business days of the note date. The email must identify the employer and the name and title of the person verifying employment, as well as the borrower’s name and current employment status. The person verifying the employment must be from the company’s Human Resources department or a Manager/Supervisor. The email must be from a business domain and not from a @gmail.com, @hotmail or @yahoo.com type account.

Third-Party Verifications: A third-party verification with companies like The Work Number will only be accepted if the vendor’s database has been updated within 14 calendar days of the note date showing the borrower is currently still employed.

Active Military Personnel: No change to Plaza or VA’s current policy.

Self-Employed Borrowers: Effective immediately for all new loans with note dates 4.2.20, Plaza will require that the existence of the business be verified within 10 days of loan closing. Due to latency in systems updates or recertifications using licenses certification, or government system of records, sellers must take additional steps to confirm that the business is open and operating. The file must reflect that the borrower’s employment has continuity of income at the time it is being verified. Examples of confirming the business is currently operating include but not limited to the following:

-

-

- Evidence of current work (recent executed contracts or signed invoices that indicate the business is operating)

- Evidence of current business receipts within 10 days of closing

- The seller verbally verifying that the business is open and operating

- Business website demonstrating activity supporting current business operations (timely appointment for estimated or service can be scheduled)

-

VA IRRRLs : No change to the current VVOE policy.

USDA Loans

For delegated loans, Plaza will require that all reverifications of employment be performed within three (3) business days of the note date. If the lender is unable to obtain a verbal verification of employment, as an alternative, an email directly from the employer within three (3) business days of the note date would be acceptable. The email must be sent to the lender from the employer and identify the name and title of person verifying employment, as well as the borrower’s name and current employment status. The person verifying the employment must be from the company’s Human Resources department or a Manager/Supervisor. The email must be from a business domain and not from a @gmail.com, @hotmail or @yahoo.com type account.

Third-Party Verifications: A third-party verification with companies like The Work Number will only be accepted if the vendor’s database has been updated within 14 calendar days of closing and shows the borrower is currently still employed.

Active Military Personnel: Plaza will follow the standard 10-day reverification requirements.

Self-Employed Borrowers: Effective immediately for all new loans with note dates 4.2.20, Plaza will require that the existence of the business be verified within 10 days of loan closing. Due to latency in systems updates or recertifications using licenses certification, or government system of records, sellers must take additional steps to confirm that the business is open and operating.The file must reflect that the borrower’s employment has continuity of income at the time it is being verified. Examples of confirming the business is currently operating include but are not limited to the following:

-

-

- Evidence of current work (recent executed contracts or signed invoices that indicate the business is operating)

- Evidence of current business receipts within 10 days of closing

- The seller verbally verifying that the business is open and operating

- Business website demonstrating activity supporting current business operations (timely appointment for estimated or service can be scheduled)

-

Jumbo Loans

Plaza will require that all reverifications of employment must be performed within three (3) business days of the note date.

Self-Employed Borrowers: Effective immediately for all new loans with note dates 4.2.20, Plaza will require that the existence of the business be verified within 10 days of loan closing. Due to latency in systems updates or recertifications using licenses certification, or government system of records, sellers must take additional steps to confirm that the business is open and operating. The file must reflect that the borrower’s employment has continuity of income at the time it is being verified. Examples of confirming the business is currently operating include but not limited to the following:

-

-

- Evidence of current work (recent executed contracts or signed invoices that indicate the business is operating)

- Evidence of current business receipts within 10 days of closing

- Seller can verbally verifying that the business is open and operating

- Business website demonstrating activity supporting current business operations (timely appointment for estimated or service can be scheduled)

-

Active Military Personnel: Plaza will follow the standard reverification requirements as detailed by the agencies.

|

3.26.20 Update - Appraisals and County Recordings

Plaza is implementing temporary changes to our processes in response to the current market environment, announcements from FHFA, Fannie Mae® and Freddie Mac, and also COVID-19 developments. Changes are effective immediately.

Appraisal Forms - Fannie Mae and Freddie Mac Loan Transactions Only

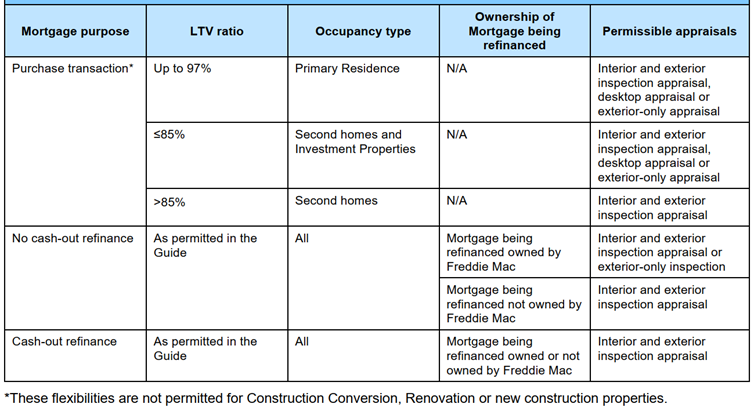

Correspondent lenders may apply Fannie and Freddie guidance on appraisals and loans will be eligible for purchase by Plaza, per the matrix below.

Temporary Appraisal Flexibility Matrix

Fannie Mae

Freddie Mac

The following links may be used to determine if Fannie Mae or Freddie Mac currently hold the mortgage on the subject property.

FNMA - https://www.knowyouroptions.com/loanlookup

FHLMC - https://ww3.freddiemac.com/loanlookup/

If the loan is currently held by Fannie or Freddie, the AUS must correlate to the existing lien holder. For example, if the existing loan is with Fannie, then the loan has to close with DU®.

NOTE: The correlating AUS only applies to selecting the appraisal product based on being a prior owned Fannie or Freddie loan. If not using an existing loan with Fannie or Freddie as the reason to select the appraisal product, then either DU or LPA® can be used.

County Recorder Closings: Gap Coverage on Title Policies on all Loan Products

Plaza will purchase loans in counties where the recording/county clerk’s office is closed, as long as, the title contains Gap Coverage with no exception for delayed recording or the county offices being closed. Plaza will continue to purchase loans in States where it is typical to fund after recording, as long as, the title policy has Gap Coverage with no exception. In accordance with Plaza’s Correspondent Seller Guide, the Lender must submit the recorded mortgage along with any other recorded documents as a trailing document to Plaza.

3.25.20 Update - AOT and Direct Trade Transactions

Due to volatility in the mortgage markets Plaza Home Mortgage® is suspending AOT and Direct Trade transactions at this time. This change is effective immediately, although we do expect it to be temporary, and we will let you know just as soon as we resume accepting AOT and Direct Trade again. We apologize for any inconvenience and appreciate your patience as we all work through this challenging time together.

3.23.20 Update - Suspension of Non-QM and Non-Conforming Loan Programs

Client service is our top priority at Plaza. During this difficult time of uncertainty in the market, we are actively monitoring and readjusting the loan programs we offer and whether we can continue to do so at the exceptional level of service we demand from ourselves.

Unfortunately, due to a current lack of liquidity in the market, Plaza is suspending all funding and purchases of loans on the following loan programs effective immediately:

- Solutions Non-QM

- AUS Non-Conforming

- Elite Jumbo QM and Non-QM

- Elite Plus Jumbo QM and Non-QM

- High Balance Access

As a reminder, we are also still offering all Fannie Mae, Freddie Mac and Government loan programs. Please be aware we continue to monitor the markets and will revisit program availability just as soon as the markets allow.